flowchart TB

Invest["💰 Investors Give $1B"]

Treaty1["📜 1% Treaty Passes<br/>$27B/year"]

Payout1["💸 Bondholders Get $2.7B/year<br/>(270% returns)"]

Mission1["🔬 DIH Spends $24.3B<br/>on cures"]

Cures["💊 Diseases Start Falling"]

Media["📺 Media Frenzy:<br/>'It's working!'"]

Public["🗳️ Public Demands More"]

Treaty2["📜 2% Treaty Passes<br/>$54B/year"]

Payout2["💸 Bondholders Get $5.4B/year<br/>(540% returns)"]

More["♾️ Cycle Continues"]

Invest --> Treaty1

Treaty1 --> Payout1

Treaty1 --> Mission1

Mission1 --> Cures

Cures --> Media

Media --> Public

Public --> Treaty2

Treaty2 --> Payout2

Payout2 --> More

Treaty2 --> Mission1

🎖️ VICTORY Bonds

Disclaimer: This section is informational and illustrative, not an offer of securities. Any actual implementation would require formal legal review and regulatory compliance.

What You’re Building

Create a funding mechanism that raises $1 billion to finance the 1% Treaty campaign through perpetual revenue-sharing bonds.

The structure to build:

- Raise $1 billion from bond investors

- Use funds to execute the treaty campaign

- Once treaty passes, $27B annually flows from military budgets to DIH

- Pay bondholders 10% of treaty inflows perpetually

- Use remaining 90% for medical research

Investor pitch: 270% annual returns if treaty passes at full scale

Key feature: Perpetual revenue share (no maturity date) keeps investors aligned with long-term success

How to Execute the Four Phases

Phase 1: Raise the Initial $1 Billion

Set up the bond offering and raise capital from investors.

Target investors:

- Institutional investors ($10M+ each)

- Family offices ($5M+ each)

- High net worth individuals ($1M+ each)

- Qualified investors ($100K+ each)

Use the capital structure detailed below.

Phase 2: Execute the Campaign

Deploy the $1B raised according to the Campaign Budget:

- Viral referendum campaign (280M votes through AI-optimized referral system)

- Strategic lobbying (AI-targeted campaigns in 20 key countries)

- Technology platform (dFDA and Wishocracy development)

- Legal and compliance (AI-assisted with expert review)

- Strategic partnerships (co-opt defense industry, align insurers)

- Operations and implementation (lean, AI-augmented teams)

For the complete breakdown of how every dollar is spent, see the Campaign Budget chapter.

Phase 3: Implement Treaty Revenue Flow

Once treaty passes, set up the revenue distribution system:

- $27B annually flows from military budgets to DIH treasury

- Automatic payment to bondholders: 10% of all inflows

- Remaining 90% flows to medical research operations

Phase 4: Manage Perpetual Distributions

Set up automated annual payments:

- Year 1: $2.7B distributed to bondholders

- Year 2: $2.7B distributed to bondholders

- Year 3: $2.7B distributed to bondholders

- Year 4+: Scale up as treaty expands (2% = $5.4B, 5% = $13.5B, etc.)

Continue indefinitely—no maturity date means revenue never stops as long as treaty remains in force.

Calculate Your Numbers for Investors

Show Them the Revenue Math

Current global military spending: $2.7 trillion/year

What the 1% Treaty redirects: 1% = $27B/year to medical research

What bondholders get: \[ 10\% \times \$27\text{B} = \$2.7\text{B}/\text{year} \]

What funds research: \[ 90\% \times \$27\text{B} = \$24.3\text{B}/\text{year} \]

What countries keep: \[ 99\% \times \text{military budgets} = \$2.67\text{T} \]

This shows investors they’re not “taking” research money—90% goes to cures.

Project Growth Scenarios for Your Pitch

Design the treaty to start at 1% and expand as breakthroughs prove the model:

| Year | Treaty % | Annual Revenue | Bondholder Payment | Investor ROI |

|---|---|---|---|---|

| 1-3 | 1% | $27B | $2.7B | 270% |

| 4-7 | 2% | $54B | $5.4B | 540% |

| 8-10 | 5% | $135B | $13.5B | 1,350% |

| 10+ | 10%+ | $270B+ | $27B+ | 2,700%+ |

Explain the growth mechanism to investors:

- Early medical breakthroughs validate the model

- Mid-stage results build political momentum

- Long-term cures create unstoppable public demand

Frame it as: Politicians face electoral suicide if they oppose expansion after cures emerge.

Structure the Security Package

Give bondholders these five layers of security:

- $27B+ annual treaty revenue stream (starts year 1 if treaty passes)

- Political entrenchment (treaties are historically hard to repeal once implemented)

- Public support (70%+ approval, grows with each cure)

- Aligned incentives (everyone profits from cooperation)

- First-lien position (bondholders get paid before any discretionary spending)

Explain to investors: Multiple layers of protection, not just one point of failure.

Present Two Scenarios to Investors

Scenario A: Full Success ($27B/year)

Show investors what full treaty adoption looks like:

Treaty adoption: 100+ countries (all major military powers) Annual DIH revenue: $27B Bondholder annual payment: $2.7B (10%) Research funding: $24.3B (90%) Investor ROI: 270% annually

What happens:

- Medical research accelerates dramatically

- Disease burden declines measurably

- Public support grows stronger

- Political momentum builds for 2%, then 5% expansion

- Returns scale up proportionally

Scenario B: Partial Success ($13B/year)

Show investors the downside case is still attractive:

Treaty adoption: US, EU, UK only (~50% of global military spending) Annual DIH revenue: $13B Bondholder annual payment: $1.3B (10%) Research funding: $11.7B (90%) Investor ROI: 130% annually

What happens:

- 130% returns still crush traditional investments

- Partial funding still produces major breakthroughs

- Early-adopter success creates FOMO in other nations

- Additional countries join over time

- Returns grow toward full scenario

Key pitch point: Even the “bad” scenario beats every other investment.

Explain Why You Chose 10%

Structure the allocation to balance three goals:

- Attract sufficient capital: 270% projected returns compete with high-risk VC/hedge funds

- Fund the mission: 90% ($24.3B) gives researchers substantial capital

- Align incentives: Bondholders profit from treaty expansion, so they become advocates

Tell investors: Everyone wins when treaties grow—more cures = bigger treaties = higher returns.

Set Up the Legal Structure

The VICTORY Bonds are issued by The Victory Corporation, a for-profit Delaware C-Corp. This entity serves as the financial “Engine” of the entire operation, designed to attract for-profit capital to fund the political and social mission.

This structure legally separates the investment activities from the philanthropic and lobbying arms of the organization. For a complete breakdown of the four-part hybrid legal model, see the Legal Architecture chapter.

Structure the Bond Instrument

Instrument type: Create as senior secured debt

Priority: Give first lien on all DIH treaty revenue

Term: Make perpetual (no maturity date)

Payment: Set annual distributions in stable currency (USD or basket)

Transferability: Allow secondary market trading

Governance: Grant bondholder seats on DIH oversight board

Create Milestone-Based Releases

Protect investors by releasing funds in tranches tied to achievements:

Phase 1 milestone ($200M release):

- Launch platform MVP

- Achieve 50M+ referendum votes

- Complete successful pilots in 2 countries

- Establish legal framework

Phase 2 milestone ($500M release):

- Reach 280M+ total referendum votes

- Get treaties pending in 20+ countries

- Scale platform to 10M users

- Secure defense industry partnerships

Phase 3 milestone ($300M release):

- Get treaty signed by 50+ countries

- Achieve $13B+ annual revenue flowing

- Have dFDA processing trials

- Demonstrate irreversible momentum

Set up protection: Hold all funds in escrow, refund if milestones aren’t hit

Address Each Risk Category

The investment carries two primary types of risk: Project Risks, which are inherent to the success of the campaign, and Investor-Specific Risks, which relate to the nature of the financial instrument.

Project Risks: - Political Risk: The treaty may fail to pass in key nations. This is mitigated by building broad, bipartisan public support and using a multi-country strategy to avoid single points of failure. - Execution Risk: The campaign may fail to achieve its milestones. This is mitigated by milestone-gated funding, a lean operational model, and hiring an elite, experienced team.

Investor-Specific Risks: - Liquidity Risk: Funds are locked up for 18-36 months during the campaign phase before returns begin. This is mitigated by allowing secondary market trading after an initial lock-up period. - Timeline Risk: The political process could take longer than projected, delaying returns. The perpetual nature of the bond is designed to reward patience.

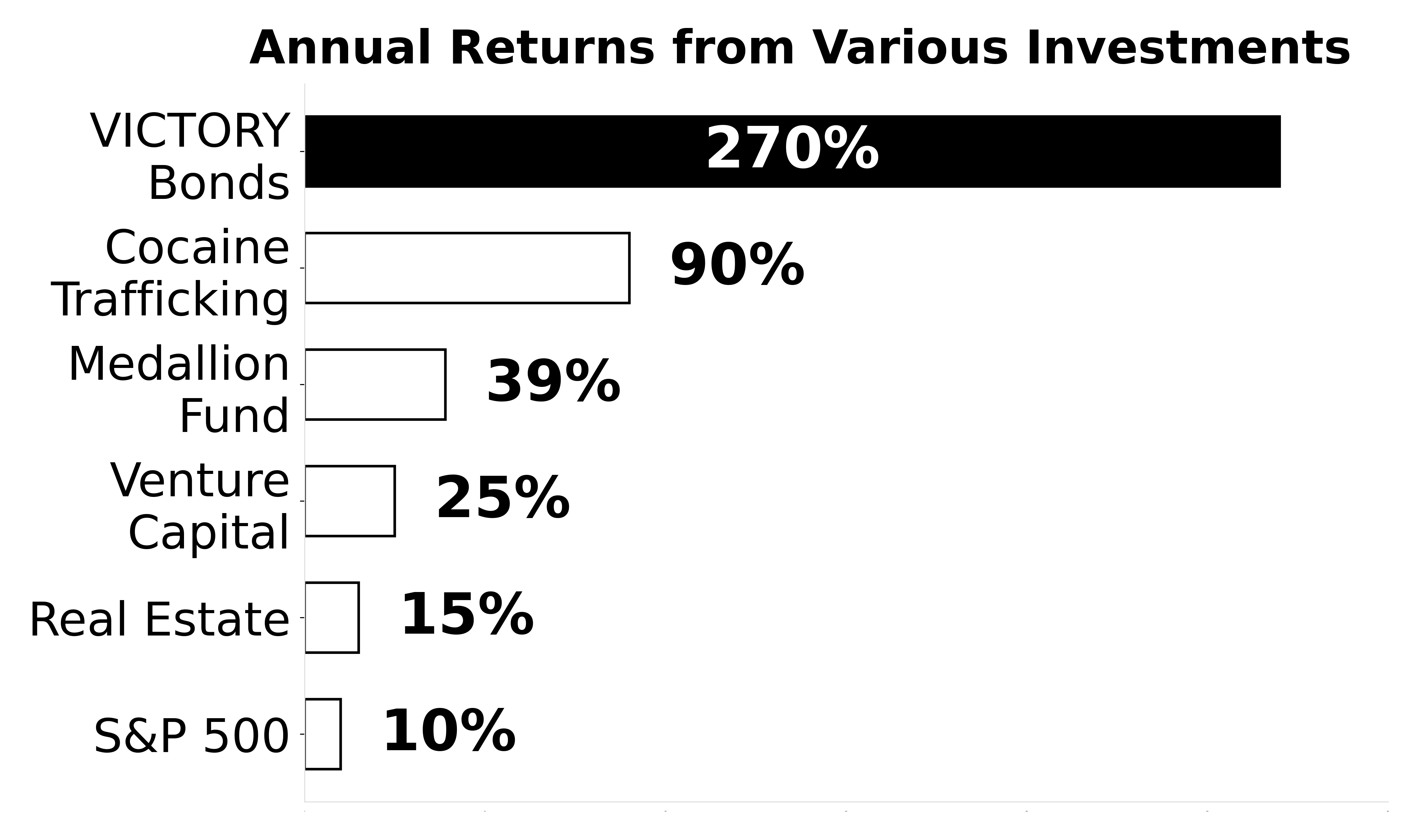

Show Investors the Comparison

Create This Comparison Table for Your Pitch

| Investment | Annual Return | Risk Level | Term |

|---|---|---|---|

| VICTORY Bonds | 270%* | High | Perpetual |

| Savings Account | 0.5% | Minimal | Liquid |

| S&P 500 | 10% | Moderate | Liquid |

| Real Estate | 8% | Moderate | 30 years |

| Venture Capital | 15-25% | Extreme | 7-10 years |

| Hedge Funds | 8-15% | High | Variable lock-up |

| Medallion Fund | 39% | Extreme | Closed to new investors |

| Warren Buffett career avg. | 20% | Moderate | 60 years |

*Remind investors: Returns assume full treaty passage. Actual results depend on political outcomes.

Pitch angle: Even with high risk, the upside crushes everything except closed funds.

The Expansion Flywheel

Explain the flywheel to investors:

- Treaty passes → Bondholders get first distributions

- DIH funds trials → Breakthroughs start emerging

- Media covers wins → Public awareness explodes

- Public demands more → Politicians face electoral pressure

- Treaty % increases → Revenue scales up dramatically

- More cures emerge → Cycle reinforces itself

- Long-term result: Compounding returns + saved lives

Frame it as: Success creates more success—self-reinforcing growth mechanism.

Set Minimum Investment Thresholds

Investor lock-up period: Tell investors funds are locked 12-36 months until treaty passes, then perpetual distributions begin.

Structure Your Minimums

Set these minimum investment amounts by investor type:

- Institutional investors: $10M+ per investor

- Family offices: $5M+ per office

- High net worth individuals: $1M+ per person

- Qualified investors: $100K+ minimum

(Adjust based on your final regulatory structure and jurisdiction requirements)

Draft Your Term Sheet

(Have lawyers review—this is illustrative only)

- Interest rate: 0% (all returns via revenue share model)

- Revenue share: 10% of all treaty inflows

- Term: Perpetual (no maturity date)

- Payment frequency: Annual distributions

- Default provisions: Transparent reporting, third-party audits

- Transferability: Tradable on secondary market after 12 months

- Governance: Grant bondholder board representation

Handle Common Investor Objections

This section focuses on objections specific to the financial instrument. For broader philosophical, political, and feasibility objections, see the main Demolishing Objections chapter.

“The returns seem unrealistic. How is this not a Ponzi scheme?”

“The returns are high because the political risk is high. This is a venture-scale bet on political change. The returns are not generated from new investors, but from a share of a new, legally mandated $27 billion annual revenue stream created by the treaty. The model is based on the proven economics of political lobbying, redirected toward a humanitarian goal.”

“What happens to my investment if the treaty fails?”

“If the treaty campaign fails to achieve at least partial success, the initial investment will be lost, as it will have been spent on the campaign. This is the primary risk. However, even a partial success scenario—such as adoption by the US and EU alone—is projected to yield over 130% annually, providing a significant return well above market averages. The risk is binary, but the upside is designed to compensate for it.”

“What are the primary risks to my investment?”

“The risks are categorized into two groups: - Project Risks: - Political: The treaty may not pass. This is mitigated by building broad, bipartisan public support and using a multi-country strategy to avoid single points of failure (see”Address Each Risk Category” section above for details). - Execution: The campaign may not be run effectively. This is mitigated by milestone-based funding releases and an experienced team. - Investor-Specific Risks: - Liquidity: Your capital is locked during the 18-36 month campaign. - Timeline: Political processes can be slow, potentially delaying the start of returns.”

“How is this different from a standard philanthropic donation?”

“Philanthropy is a donation with an expected financial return of zero. VICTORY Bonds are a for-profit investment instrument, structured as debt, with a projected 270% annual return. While the outcome is profoundly impactful, the vehicle is a financial one designed to attract capital, not donations.”

When they want detailed financials

Direct them:

“Complete breakdowns available:

- Campaign Budget: The $1B War Chest - Where every dollar goes

- Financial Plan - System architecture

- Full offering docs - Email for access”

Your One-Page Summary for Investors

Create this summary sheet for quick investor review:

VICTORY Bonds: High-Risk, High-Return Treaty Campaign Funding

What you’re offering:

- Returns: 270% annually (if full treaty passes)

- Duration: Perpetual revenue share (no maturity)

- Impact: Funds medical research to save millions

- Security: First-lien on treaty revenue

- Growth: Treaty designed to expand 1% → 2% → 5%+

What you’re risking:

- Political: Treaty must pass across multiple nations

- Execution: Campaign must hit milestones

- Timeline: 18-36 month lockup before returns

- Liquidity: Limited during campaign phase